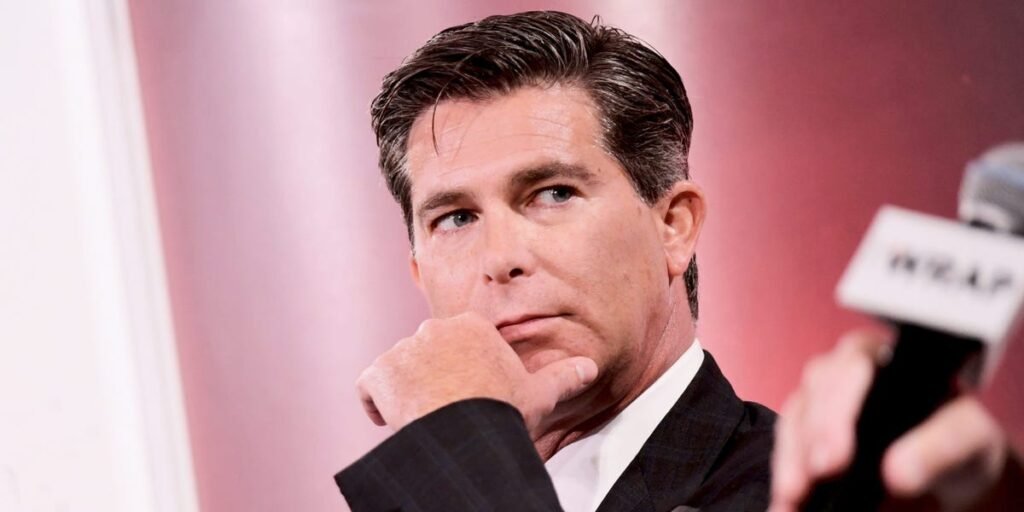

Tech investor Ross Gerber said the AI boom is nothing like the dot-com bubble — and Warren Buffett was wrong to slash his Apple stake.

The cofounder and CEO of Gerber Kawasaki Wealth and Investment Management told Business Insider that he “traded through” the internet mania around the turn of the millennium. The AI craze “just isn’t comparable,” he said.

The S&P 500’s 20%-plus returns in 2023 and 2024 may seem unsustainable, but the benchmark index delivered similar returns for five years from 1995 through 1999, Gerber said. He started his career with “perfect timing” in 1994, he added.

When Magnificent Seven companies trade at lofty earnings multiples, they’re considered overvalued “because people have never seen numbers that big,” Gerber said. But the tech investor said their valuations aren’t out of sync with their businesses, calling their profitability “just insane.”

Alphabet generated more than $100 billion in net income last year, while Nvidia’s profits rose by over 50% year on year last quarter.

Gerber, whose firm invested in Tesla and Nvidia around a decade ago and now manages north of $3 billion in client assets, added that AI had enormous potential to increase productivity and earnings. He contrasted it with smartphones, which he called “counter useful” and “time wasters.”

Gerber says Berkshire Hathaway has a ‘portfolio of the past’

Warren Buffett’s Berkshire Hathaway has taken little interest in the AI frenzy, even selling nearly 70% of its Apple stake in the 18 months up to June 30.

Related stories

Gerber told Business Insider he thought that Buffett may have pared the position because it had become too “heavy” — it was worth $174 billion or around half of Berkshire’s entire stock portfolio at the end of 2023.

But Gerber said he still thought the sale was “dumb” because “it was a huge realized gain that is taxable, and there’s nothing that he could invest in that’s better than Apple in the long term,” he said.

Gerber said Apple would “continue to mint profits for a very long time and be a part of our kids’ lives forever,” adding that he didn’t see any “wisdom” in selling.

Gerber Kawasaki counted Apple among its top holdings at the end of June with a $78 million position, per its latest portfolio filing.

Gerber said many of Berkshire’s stocks and subsidiaries, such as the BNSF Railway, “haven’t done that well” in recent years.

Berkshire had the “perfect portfolio of the past, but it’s definitely not the perfect portfolio of the future,” he said, adding that incoming CEO Greg Abel and his team will “have a lot of work to do” to reposition it.

Thomson Reuters

Gerber also criticized Buffett for betting on Kraft Heinz, which on Tuesday said it would split into two companies.

Gerber said that he had openly questioned the investment during a shift in consumer tastes toward healthier options, and why Buffett had partnered with a private equity firm, 3G Capital, known for making substantial layoffs.

“I don’t see where value’s created on a bunch of old brands that nobody wants,” Gerber said. “And just by firing people, it’s just not going to create any economic value. And that ended up proving to be true.”

Berkshire didn’t respond to a request for comment from Business Insider.

Gerber on meeting Buffett: ‘I realized … he’s no joker’

Gerber recalled meeting Buffett during the 2008 financial crisis at an event for then-presidential candidate Barack Obama.

Gerber, who was working for AIG-owned SunAmerica, told Business Insider that he approached the Berkshire chief to ask if he’d consider acquiring AIG to help relieve the insurance giant’s troubles.

“And he looked at me like, ‘you’re out of your mind,’ and got in the car and left,” Gerber recalled. “And I realized when I looked this guy eye to eye like, this guy, he’s no joker at all.”

The US Government acquired around 80% of AIG in September of that year, one of a series of bailouts of companies that were deemed “too big to fail.”

People may see Buffett as a “stodgy, old, fun, nice guy” because he “plays that role really well,” Gerber said, but in reality, he’s “one of the most cutthroat businessmen of all time.”

Gerber said Buffett was “retiring on top” by stepping down as CEO at the end of this year, having “set up his successors in a perfect way” with the power and cash to realize their visions.

There’s “something great” about those who recognize it’s time to “leave gracefully,” Gerber said. “I think Buffett’s done a great job of that.”